Beyond payroll: Building a future-ready finance stack for BPOs

- Link copied

The BPO industry is booming across Southeast Asia, with the Philippines and Vietnam emerging as global powerhouses. It now employs millions of people who drive everything from customer support and IT services to analytics and back-office operations. BPO firms are now the backbone of the international business sector.

Yet, while headlines celebrate rapid growth and expanding contracts, a quiet challenge looms: BPO finance teams are struggling to keep up with the growth, and that is directly impacting the scale of growth.

As BPOs scale across borders, CFOs face increasingly complex operations:

- Paying thousands of employees in multiple currencies (PHP, VND, USD, SGD)

- Managing growing cross-border vendor payouts

- Navigating FX volatility and liquidity gaps that can quickly impact margins

Payroll is only the surface. Beneath it, you’ll find BPO finance teams struggling with disconnected systems, manual spreadsheets, and slow-moving cash.

CFOs need a modern finance stack that brings together payments, cash management, and liquidity forecasting in a single, real-time view to transform finance from a back-office chore into a strategic growth driver.

Macro trends reshaping the BPO landscape

In the Philippines, the BPO sector generated over USD 38 billion in revenue in 2024 and now employs more than 1.7 million people. Vietnam, while smaller, is fast emerging as the next regional hub with USD 2.5 billion in BPO exports and projected annual growth of up to 30% depending on vertical.

Even as demand accelerates, operational costs are climbing. Inflation across Southeast Asia has driven up salaries and infrastructure expenses.

At the same time, client expectations are evolving. Global customers now demand real-time delivery, AI-enabled insights, and on-demand scalability–all of which depend on fast, reliable financial operations behind the scenes.

This combination of growth, rising costs, and heightened client demands has thrust BPO finance teams into the spotlight. CFOs are now expected to handle

- Currency volatility: Managing USD collections from clients while paying employees in PHP, VND, and other local currencies to mitigate FX swings that can potentially eat into margins.

- Talent costs and global payroll: Processing multi-currency salaries and benefits for rapidly expanding teams, often across time zones.

- Client demands for global delivery: Ensuring multi-currency billing, fast collections, and transparent reporting to maintain client satisfaction and support contract renewals.

Rapid growth creates great opportunities, but financial complexity threatens margins, agility, and scalability. CFOs must manage these pressures while keeping the business nimble–a challenge most legacy finance systems aren’t built for.

The CFO challenge in BPO finance

For finance leaders, three challenges dominate the BPO finance agenda: payments, cash management, and liquidity.

Payments

Managing payouts across multiple countries is operationally heavy. Every cycle brings delays, FX markups, and compliance friction. Payroll runs can take days, with vendor payments requiring multiple approvals.

When teams handle thousands of disbursements across PHP, VND, USD, and SGD, even small inefficiencies create huge cost leakages. In fast-scaling BPOs, this becomes unsustainable.

Cash management

For most BPOs, cash management is where growth friction shows up first. Global collections are scattered across multiple accounts, currencies, and banking partners. And when client payments arrive in different currencies or through regional subsidiaries, it forces the finance teams to manually match each payment to its corresponding invoice. This slows down reconciliation, delays reporting, and increases the risk of missed or duplicated entries.

Liquidity management

Without real-time visibility into balances and inflows, CFOs can’t optimize working capital or hedge FX exposure effectively.

Then there’s the problem of cash sitting idle in local accounts that aren’t connected to a central treasury, making it nearly impossible to see how much cash the business actually has at any given time.

Short-term borrowing becomes the default buffer and the high interest rates directly affect business margins.

What’s at stake: The consequence of standing still

Failing to modernize finance operations carries tangible risks for BPOs:

- Decreased margins: FX losses and unoptimized cash flows increase operational costs.

- Payment delays: Employees and vendors experience late payouts, impacting morale, retention, and trust.

- Client dissatisfaction: Slow collections and opaque reporting hinder responsiveness to clients.

- Growth bottlenecks: Inability to predict cash availability or plan working capital slows hiring, expansion, and acquisition opportunities.

On the other hand, modernizing finance operations helps CFOs become strategic growth enablers. Here are the benefits of a modern finance stack:

- Liquidity as a competitive edge: Real-time visibility turns idle cash into strategic capital, enabling faster hiring, smarter investments, and more agile growth decisions.

- Stronger margins and smarter pricing: Optimized liquidity and FX control strengthen margins and allow BPOs to offer competitive pricing without compromising profitability.

- Free up CFO bandwidth for strategy: Automation frees CFOs from manual reconciliation and other finance tasks, letting them focus on growth planning and strategic decision-making.

What does it take to build a future-ready BPO finance stack

A future-ready finance stack must combine insight, execution, integration, and compliance to transform finance from a reactive task into a strategic advantage.

Here are the key capabilities your future-ready BPO finance stack should have:

- Centralized payments and collections: You should be able to automate cross-border payroll, vendor payouts, and AR/AP across multiple currencies and entities.

- Real-time dashboards: Tracking balances, reconciling accounts automatically, and identifying idle cash should be possible in real-time.

- Actionable forecasting: Accurate, real-time forecasting should allow you to anticipate cash needs, hedge FX exposure, and optimize working capital.

- Seamless integration: Ability to directly integrate ERPs, accounting systems, and bank accounts to reduce complexity.

- Embedded compliance: Real-time AML/KYC checks, fraud detection, and regulatory updates should be embedded directly instead of being an afterthought.

How Finmo powers finance for modern BPOs

Finmo is a connected treasury platform that is built to help fast-scaling BPOs simplify financial complexity across borders, currencies, and entities. It goes beyond payroll or simple payments, giving CFOs real-time visibility, execution tools, and strategic insights to turn finance into a competitive advantage.

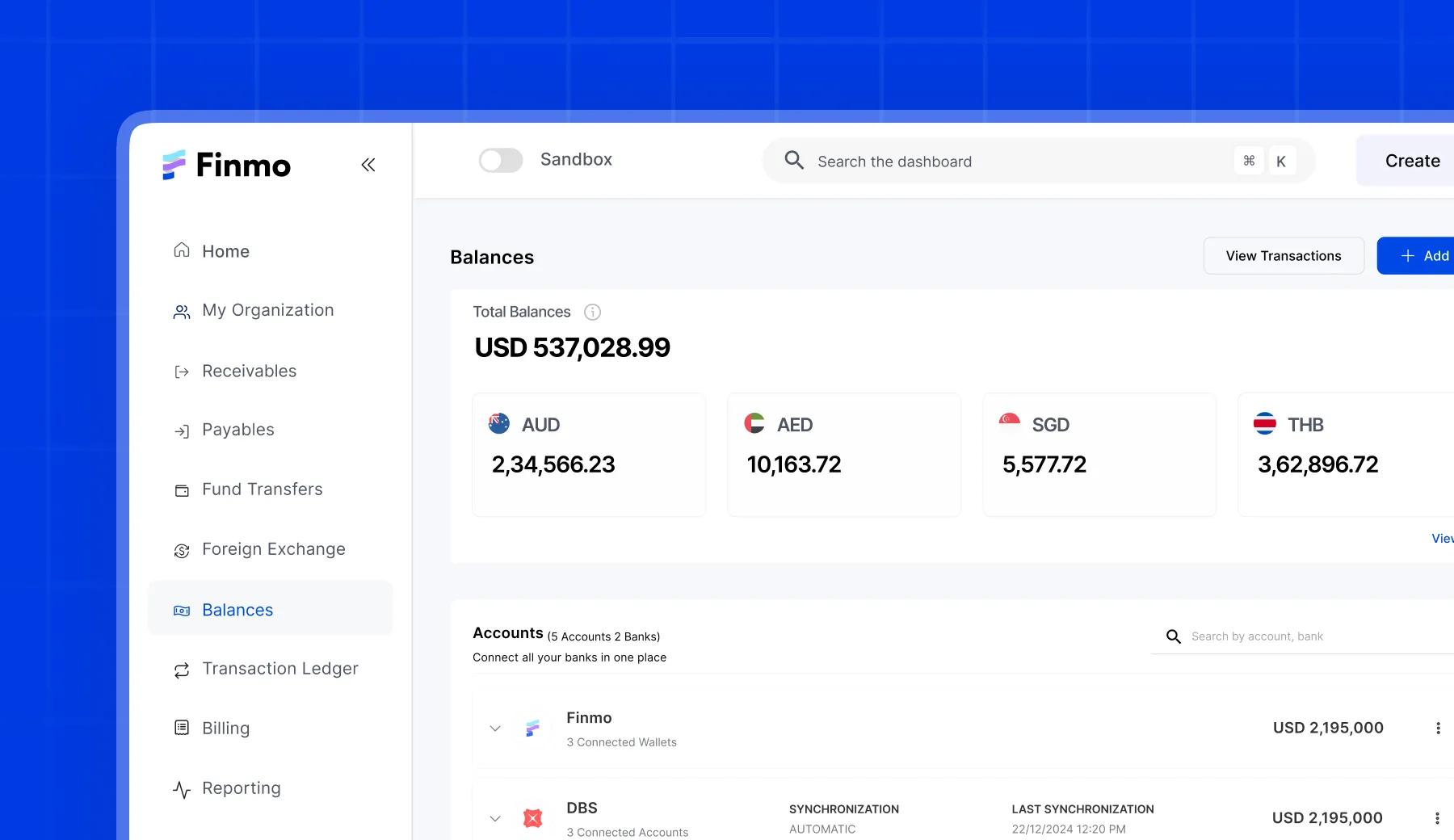

Real-time visibility

Finmo consolidates fragmented financial data from global bank accounts, ERPs, and accounting systems into one real-time dashboard, which helps CFOs get instant insight into:

- Where cash sits, in which currency, and how it’s moving

- Full payment life-cycle visibility, from initiation to settlement

- FX exposures across currencies to plan hedging and reduce risk

- Upcoming payables and receivables to forecast working capital needs

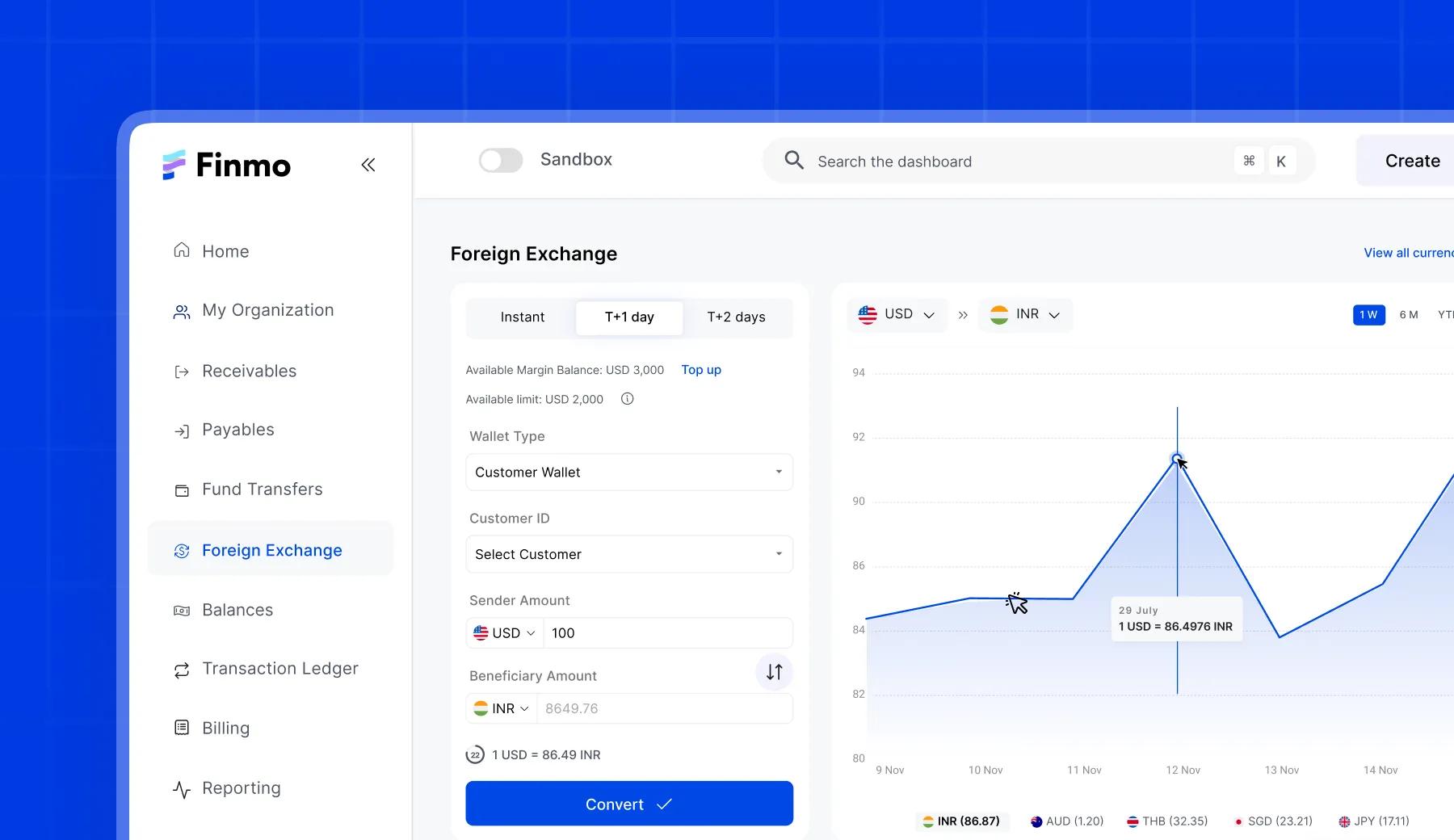

Protecting margins with FX Tools

Finmo equips BPO CFOs with enterprise-level FX hedging tools to manage volatility and safeguard profitability.

- Transparent rates with no hidden spreads for 36+ currencies

- Flexible rate locking for up to 24 hours on major and emerging currencies

- Automated hedging strategies, executed by the platform to maintain a predictable cash flow

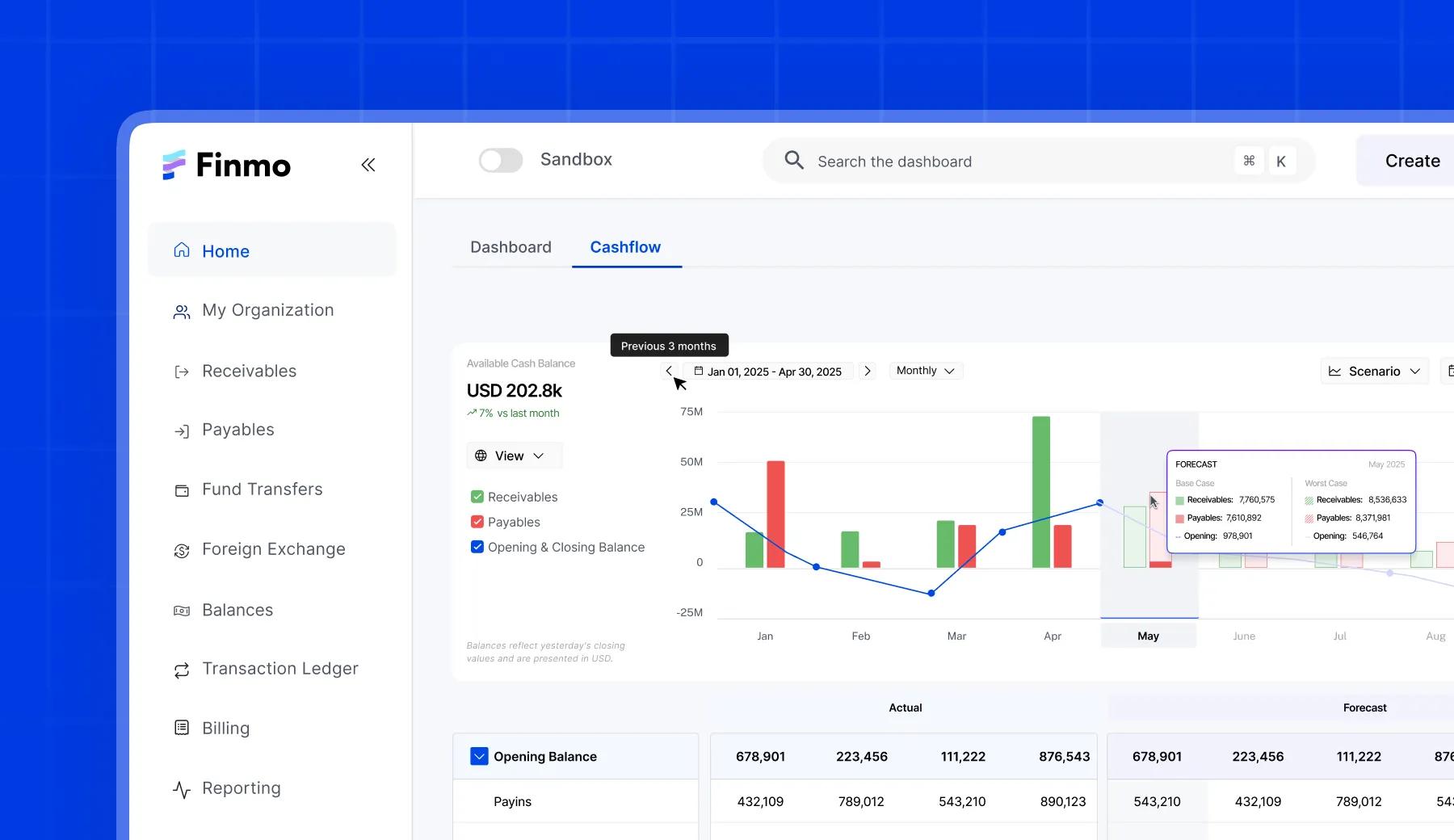

Reliable forecasting for strategic decisions

Finmo transforms cash forecasting from guesswork into strategic insights.

- Combines real-time bank transactions, invoices, bills, receivables, and payables into one connected dashboard for dynamic, data-driven forecasting.

- Lets you test ‘what-if’ scenarios such as delayed payments, unexpected expenses, or faster revenue cycles so you can see the impact instantly.

- Tracks historical trends, seasonality, and projected cash positions to give a cohesive, end-to-end view of your cashflow story.

Compliance and risk protection

Finmo embeds data protection into daily workflows, helping BPOs meet evolving regulatory requirements without burdening teams.

- Real-time AML/KYC and fraud monitoring

- End-to-end data encryption and configurable residency

- Licensed and compliant across six jurisdictions (and expanding)

Finmo doesn’t just help manage finance; it gives CFOs the insights they need to expand confidently into new markets and stay agile.

The CFO roadmap to a future-ready finance stack

Upgrading finance doesn’t have to mean overhauling everything at once. Start with focused steps:

- Audit your current workflows: Identify manual bottlenecks in payroll, vendor payments, and reconciliation.

- Map your liquidity: Find where cash is idle or delayed across accounts.

- Pilot visibility tools: Start tracking multi-currency balances in real time.

- Automate and integrate: Connect FT to your ERP or payroll systems to unify data.

- Forecast and optimize: Use real-time dashboards to plan cash allocation and manage FX exposure proactively.

Final words

BPOs are powering Southeast Asia’s next growth story, but to sustain that momentum, finance teams must evolve beyond payroll and manual processes.

By unifying payments, cash management, and liquidity under a single intelligent platform, CFOs can unlock new agility, control, and scalability.

Learn how Finmo can help your finance team simplify global operations.