Cutting‑edge treasury capabilities for your clients

Give your customers a world-class, real-time treasury and payment experience. Avoid the complexity of custom builds and crossborder compliance – and stay in control of the customer relationship.

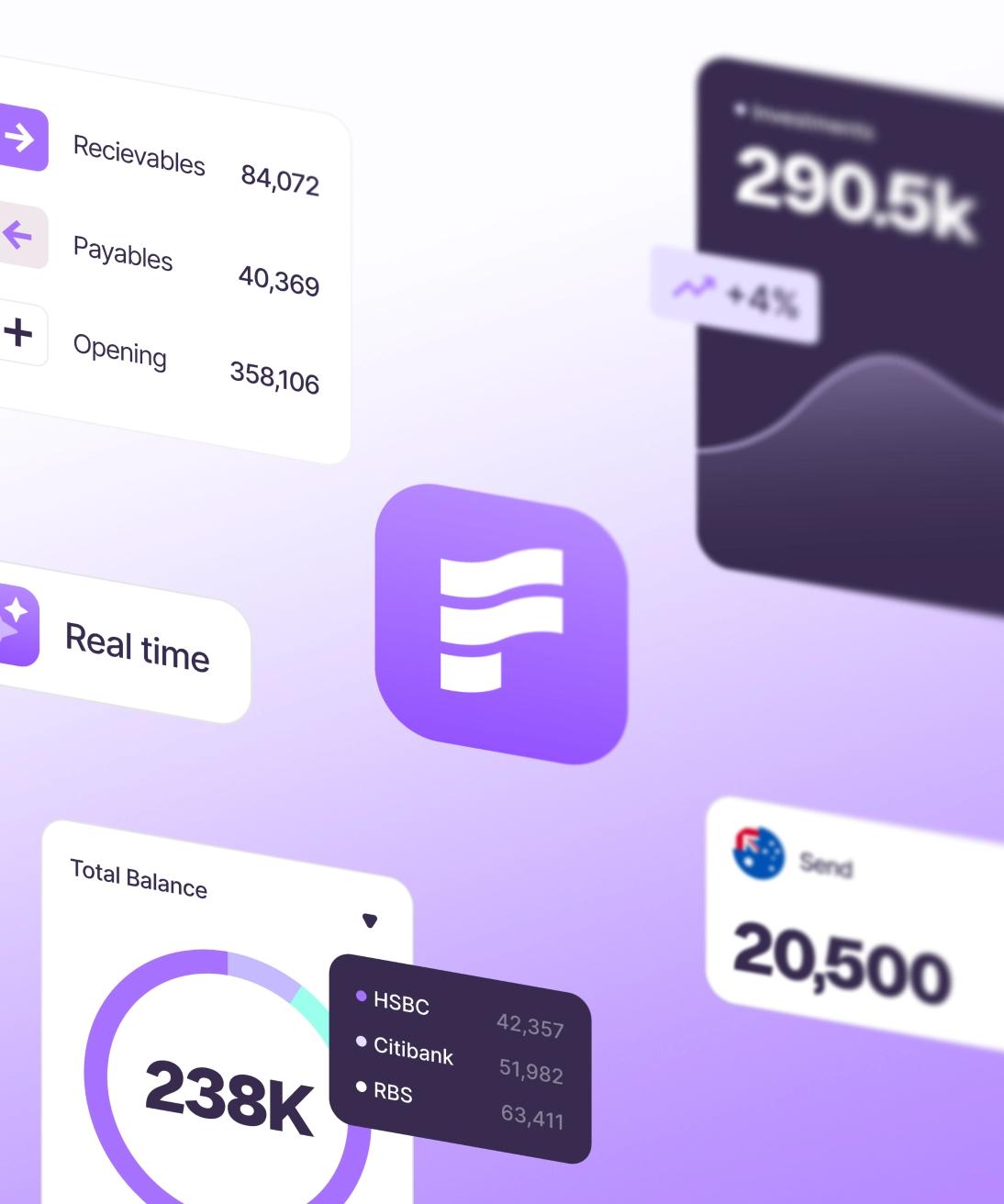

Connected financial intelligence and control

Finmo combines a proven suite of modern financial management products, built with modern API-first scalable architecture. Using our technology, your clients can integrate and view all their financial and bank data, move money globally, forecast and optimise liquidity, and manage FX risk.

A proven white‑label product

Use our existing infrastructure to deploy a complete enterprise-level treasury experience from a single API integration – and bypass years of development time. Or enhance your existing experience, using individual products from our modular stack.

Access bank accounts, ERPs and accounting software, via pre-built integrations – to create one financial command centre.

Connect financial data across banks and softwares to get real-time visibility of cashflow.

Forecast faster and further with granular analysis and dynamic modelling of future cash positions.

Optimise working capital with smarter FX hedging to reduce risk, and safe, no lock-in investments.

Keep customers on side

Integrated treasury software is becoming mission critical to modern CFOs and finance teams. By giving demanding customers a wider choice of integrated treasury tools, you can reduce churn and increase additional cross-selling opportunities.

Create new revenue streams

Depending on the partnership model you choose, Finmo offers a wide potential for new revenue streams ranging from FX conversion and transaction fees, to subscriptions for advanced services or lending short-term working capital.

Ways to partner with us

Choose the right model to fit your financial institution.

You control the customer relationship and regulatory compliance. We provide the infrastructure – and create a suitable shared revenue model.

Deliver best in class functionality by integrating key modules from our platform – from real time payment capabilities to automated risk management.

Partner with Finmo to target businesses that need your financial or banking services, and Finmo’s modern treasury tools. A shared venture and responsibilities.

Expert support to deliver success

Driven by passion and dedicated to innovation, Finmo’s executive team has over 100 years combined experience launching and leading globally recognised fintech, payments and compliance companies.

Ongoing product development and clear roadmaps.

Collaborative teams combining technical resources from both sides.

Regular business reviews and optimisation based on feedback.

Dedicated customer success team with 7-day a week support.

Control your customer data

Whichever level of integration and customisation you choose from our different models, our multi-tenant architecture ensures data isolation between partners and leaves the customer data firmly in your control.

Discuss a partnership

Take 10 minutes to watch our walkthrough. Or get in touch to speak to our partnership team.