3 warning signs your liquidity strategy isn’t working (& how CFOs can fix It)

- Warning sign #1: You don’t have real-time cash visibility

- How Finmo helps get more visibility

- Warning sign #2: FX risks are affecting your margins

- How Finmo helps protect margins

- Warning sign #3: Your forecasts never match reality

- How Finmo makes forecasting reliable

- Build an effective liquidity strategy before it's too late

- Link copied

Liquidity failures rarely come with a warning. By the time problems surface, it’s usually too late to respond without damage.

For CFOs, the challenge isn’t just knowing how much cash the business has today. It’s about seeing what’s coming next and having the ability to act before gaps turn into crises.

That’s why building a resilient liquidity strategy is no longer optional. Recognizing the early warning signs of failure is the first step to protecting working capital, strengthening treasury operations, and giving your business the confidence to grow.

Warning sign #1: You don’t have real-time cash visibility

If your finance team generates only month-end cash flow reports or needs to log into multiple bank portals just to piece together your cash position, you are already operating on blind spots. That delay in reporting forces CFOs to make decisions on outdated data–trapping cash in the wrong places, creating liquidity gaps, and making it harder to optimize working capital.

The pandemic made this weakness painfully obvious. Many mid-market businesses realized too late that profitability alone doesn’t guarantee resilience. Without a real-time view of your liquidity, even well-run companies face survival risks.

As Michael San Diego, EON Group put it, “If you don’t have extra funds (or don’t know if you have extra funds), it’s really difficult to survive another pandemic-like situation or even execute your next growth strategy.”

Without real-time data, CFOs often:

- Overestimate available cash, leading to overdrafts or emergency borrowing

- Underestimate liquidity, leaving idle funds uninvested

- Miss warning signals, failing to spot tightening working capital early

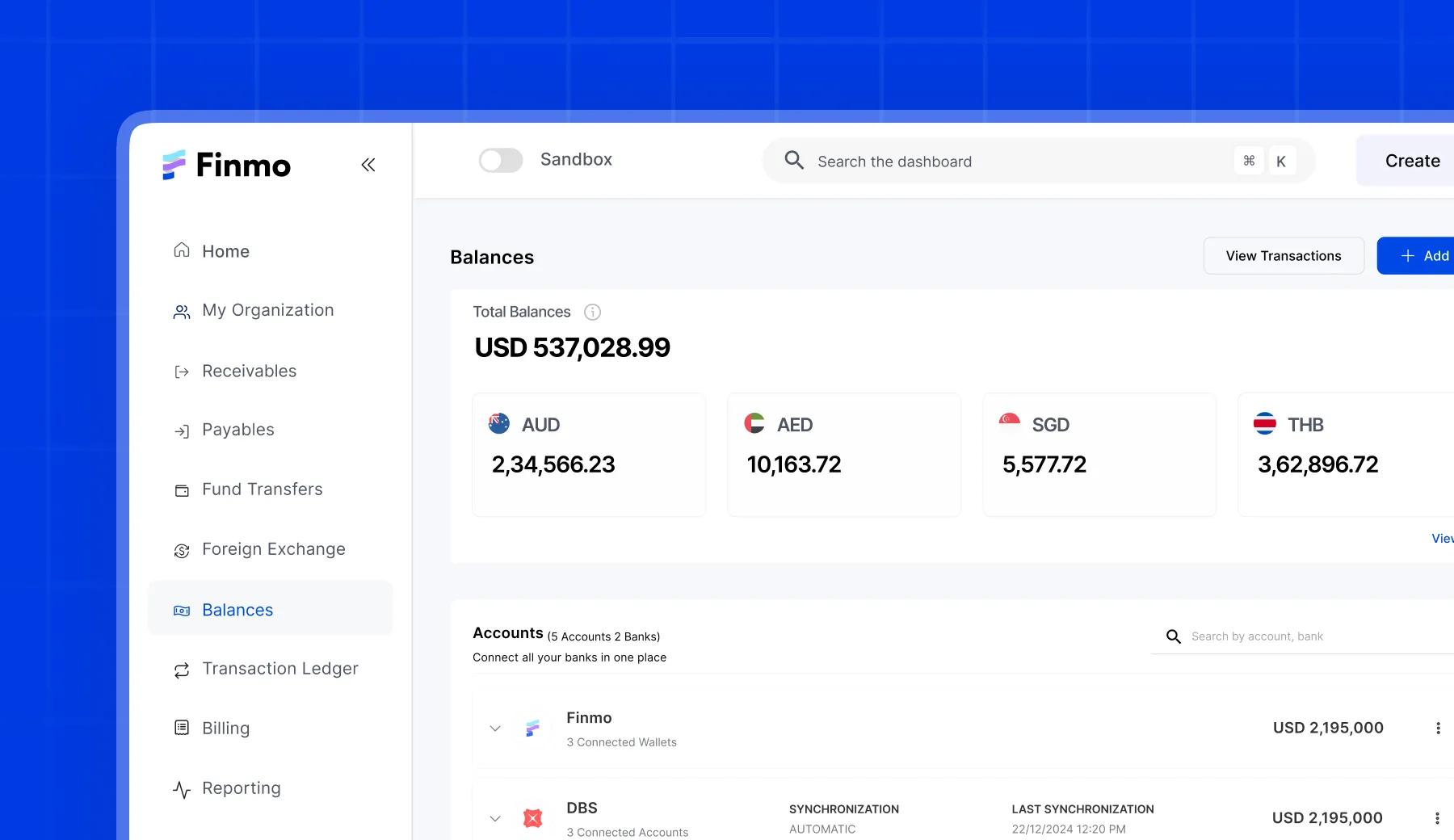

How Finmo helps get more visibility

Finmo’s connected treasury platform turns fragmented financial data into a single source of truth for liquidity. Connecting directly to your global bank accounts, ERPs, and accounting systems, it gives you a real-time, consolidated dashboard across currencies, entities, and regions.

Instead of chasing bank account statements or stitching spreadsheets, CFOs get a real-time view of:

- Where cash sits, in which currency, and how it’s moving

- Full payment life-cycle visibility--from initiation to settlement

- FX exposures across currencies to plan hedging and reduce risk

- Upcoming payables and receivables to forecast working capital needs

Warning sign #2: FX risks are affecting your margins

Revenue in one currency, expenses in another, sounds manageable until exchange rate swings wipe off your already thin profit margins overnight. For SMEs, these silent leaks affect both P&L and cash flow.

Even a small FX movement can:

- Make supplier payments significantly more expensive

- Shrink gross margins on international sales

- Turn a profitable contract into a loss-making one by the time invoices are settled

Without real-time visibility into exposures, CFOs are left reacting instead of planning. There’s no way to hedge proactively, which means liquidity forecasts become unreliable and working capital gets harder to manage. In the current volatile environment, where geopolitical instability and shifting interest rate cycles amplify currency swings, growing businesses cannot afford to ignore FX.

Though remember: managing FX risks isn’t about trying to beat the market. It’s about taking uncertainty off the table so your business can grow with confidence.

That’s why CFOs need to ask the hard questions, because without clear answers, FX risks keep compounding in the background:

- Where exactly are we exposed to currency risks?

- How much of our yearly FX volume can we forecast with confidence?

- What level of volatility can we tolerate without jeopardizing margins, obligations, or payroll?

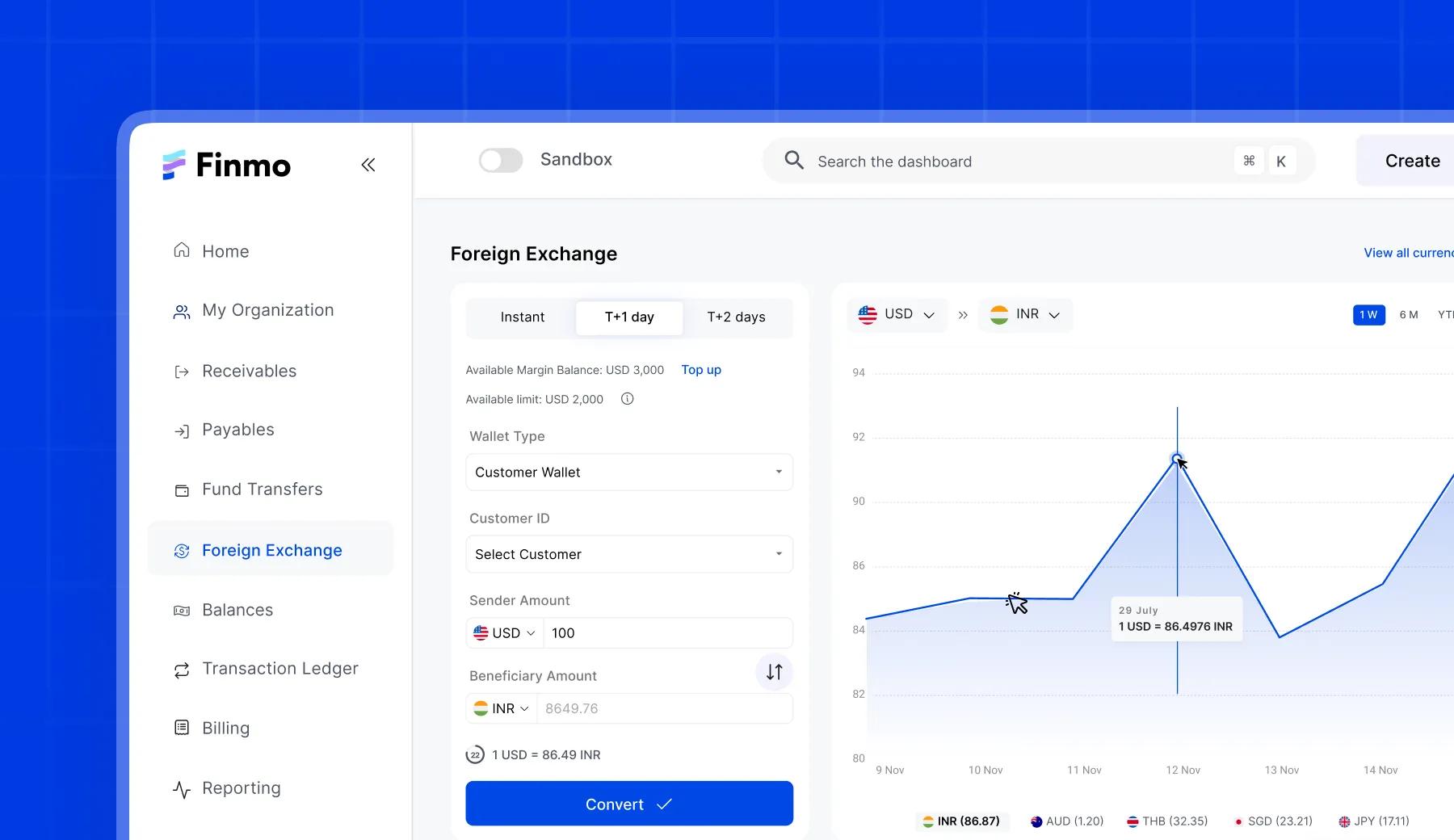

How Finmo helps protect margins

Finmo gives CFOs enterprise-level FX tools to manage risks with clarity:

- Real-time cash positioning: See where cash is coming in and going out across different currencies and accounts.

- Transparent rates with no hidden spreads: Access live, competitive FX rates for 36+ currencies with full visibility.

- Flexible rate locking: Secure FX rates for up to 24 hours on major and emerging currencies to protect margins.

- Automated hedging strategies: Decide when and how much to hedge, and let the platform execute it automatically, ensuring cash flow predictability without extra manual work.

Warning sign #3: Your forecasts never match reality

When forecasts consistently miss the mark, the problem isn’t bad math, it's bad visibility.

Without clear accountability and connected data, companies struggle to match cash estimates with actual performance. The result: future planning and scenario modeling become guesswork instead of strategy.

The cost of inaccurate forecasting is steep:

- Unexpected cash shortages that force emergency borrowing

- Higher financing costs that erode margins

- Delayed projects and strained supplier relationships

- Eroded investor confidence, as credibility takes a hit

Worse, some forecasts may appear accurate but mask underlying weaknesses, creating a false sense of security that leaves CFOs blindsided when reality diverges.

On the flip side, EY reports that companies with strong forecasting practices can reach up to 90% quarterly accuracy against enterprise-level cash flow targets.

Instead of stockpiling cash or operating in crisis mode, the best-run companies build a strong liquidity strategy, which helps ensure the business has the right amount of cash available, in the right currency, at the right time. It gives CFOs the confidence to fund growth initiatives, cover obligations, and respond quickly to market shifts, without scrambling for emergency financing or holding excess reserves that drag down returns.

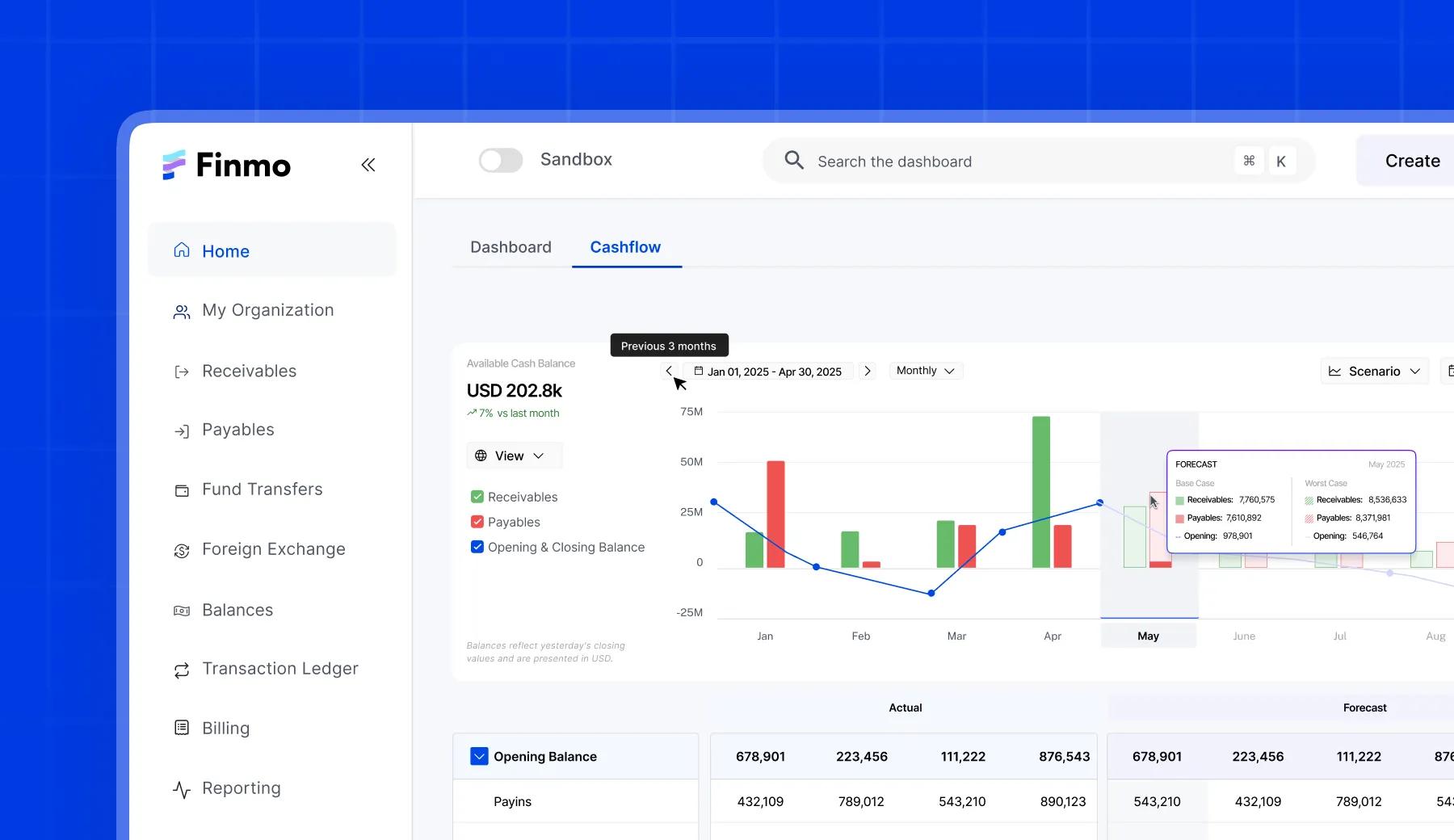

How Finmo makes forecasting reliable

Finmo’s forecasting engine transforms your liquidity planning from guesswork into strategic foresight:

- Dynamic forecasting powered by real-time data: Finmo projects future cash positions by combining real-time bank transactions, invoices, bills, receivables, and payables, all in a unified dashboard.

- Empowered scenario simulation and instant switching: Test “what-if” scenarios like delayed payments, unexpected expenses, or accelerated revenue, and instantly view the impact. Toggle between best‑case and worst‑case scenarios seamlessly to compare outcomes side by side.

- Customizable scenario inputs and visualizations: Make high-level adjustments (such as overall percentage shifts) or drill into granular modifications for individual receivables/payables. Visualize outcomes side-by-side in both graph and table formats and then export presentation-ready reports for stakeholder alignment.

- One cohesive cashflow story: View your entire cash yet-to-be story in one intuitive dashboard–tracking historical trends, seasonality, and performance—all without spreadsheets or broken workflows.

Build an effective liquidity strategy before it's too late

Liquidity failures aren’t a matter of bad luck; they’re the predictable outcome of disconnected systems and limited visibility. With Finmo’s connected treasury platform, CFOs gain a single source of truth for cash, FX, and forecasts. That means fewer surprises, stronger liquidity strategies, and the confidence to steer the business with precision.

Any information provided on this website is for general information purposes only and does not take into account your objectives, financial situation or needs. Please consider our Financial Services Guide and Product Disclosure Statement and if the information is right for you before acquiring the product or service.