June newsletter: Finmo’s latest updates in treasury management

- Link copied

Welcome to the June edition of Finmo Pulse, your go-to source for the latest updates, tools, and innovations from Finmo.

Every feature we launch is designed with today’s CFO in mind; someone navigating global operations, complex cash flows, and the need for faster, data-driven decisions. In this issue, you’ll find new tools built to meet those exact demands: a reimagined client portal, end-to-end AR/AP automation, expanded corridors, and the debut of MO.Ai, our AI copilot for treasury.

Finmo is more than just infrastructure. It’s the unified platform modern finance teams are choosing to simplify complexity and scale with confidence. Let’s get into it.

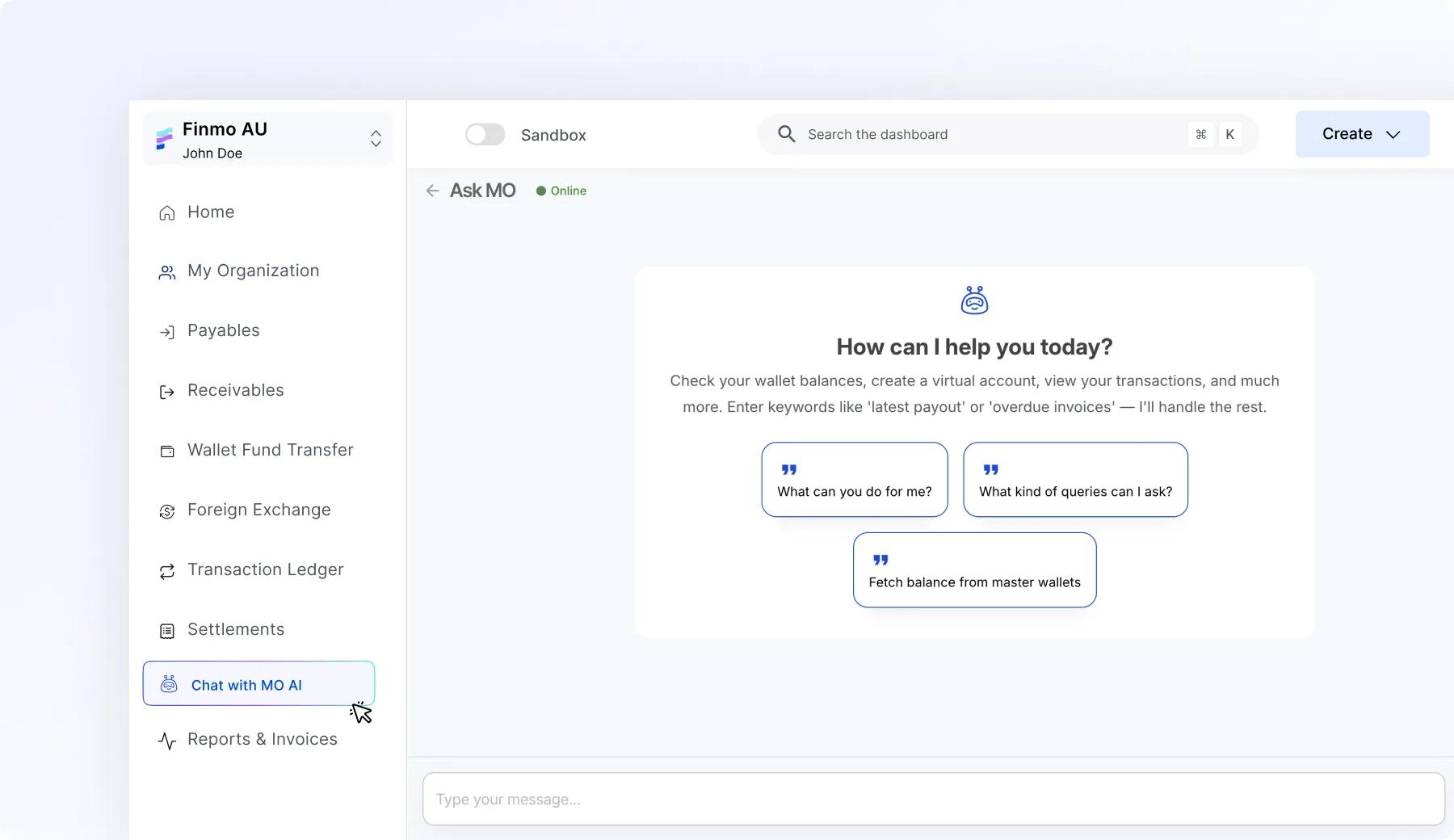

Introducing MO.Ai: Your New Finance Copilot at Finmo

We didn’t just join the AI conversation, we built something practical for CFOs.

MO.AI is Finmo’s conversational, contextual AI assistant, built right into your dashboard. It understands finance, knows your data, and helps you get things done, instantly. No more digging through dashboards or switching tabs.

Just type a prompt, and MO handles the rest:

- “What’s my account balance across currencies?”

- “Create a Payment Link for USD 1,200”

- “Analyze payouts to Europe from last week”

Whether it’s insights, actions, or answers, MO.Ai makes it all effortless.

- 🧠 Built for the way finance teams think.

- ⚡ Fast, accurate, and always on.

- 🤖 Finance, reimagined - one prompt at a time

Product Highlights

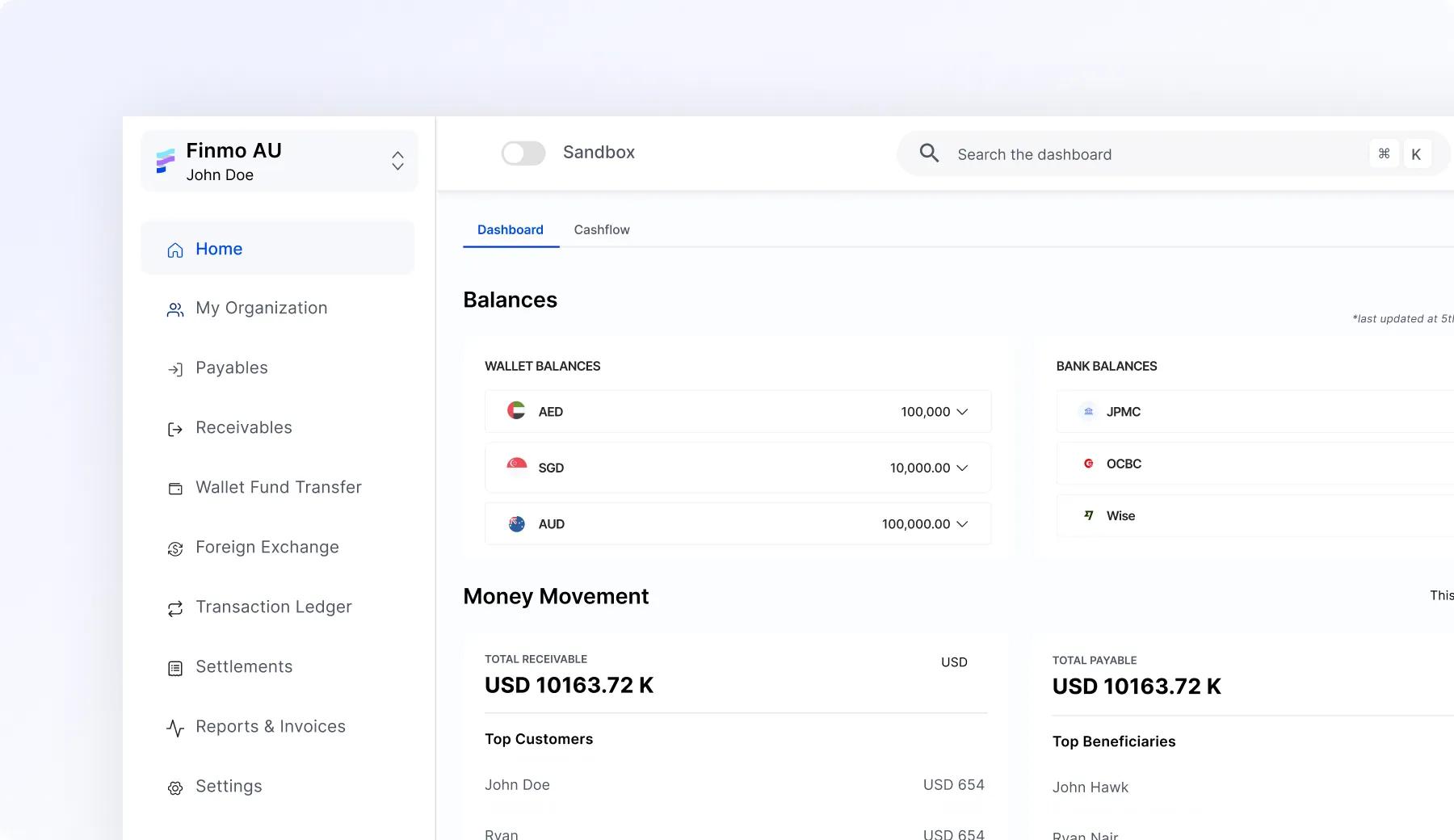

The New Finmo Portal Is Live!

Here’s what’s new:

- Merchant-Centric Design: Designed for simplicity and ease, the portal’s modular interface offers seamless navigation and unified access, built around your daily workflows.

- Unified Treasury Hub: Pay-ins, pay-outs, conversions, and balances are now centralized in a single platform.

- Fast, Frictionless Actions: Universal search and top-bar shortcuts let you initiate key actions instantly, saving time and reducing friction.

- Contextual & Real-Time Insights: The new Analytics Module delivers real-time, transaction-level insights. Monitor receivables, payables, top customers, payin /payout flows, virtual accounts, and more, all from a single dashboard

- Scalable Architecture: Built on flexible architecture that supports AR/AP invoicing and dynamic cash flow tools, ready to scale with your business without disrupting operations.

⚠️ Reminder: The old portal will be decommissioned on 1 July 2025 in a phased manner. If you’re an existing merchant, please make the switch now to avoid disruption.

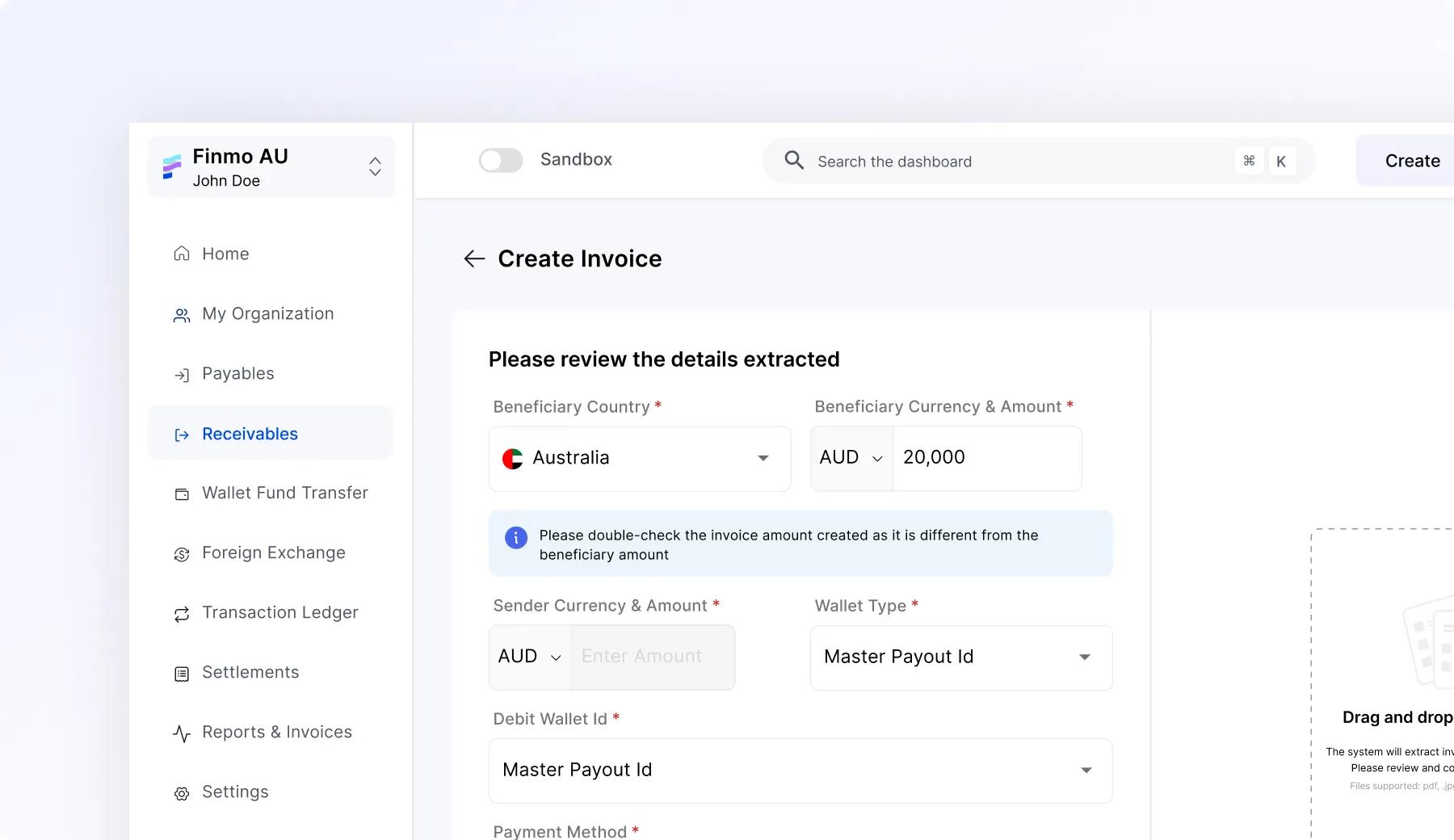

Accounts Receivable and Accounts Payable, Now Embedded in Your Finmo Portal

Our latest upgrade brings fully integrated AR and AP tools directly into the Finmo platform, helping you streamline collections, manage payouts, and take full control of your cash flow.

Accounts Receivable: Take Control of Your Collections

- Create & Manage Invoices: Build professional invoices using customizable templates and manage them all from a centralized dashboard.

- Smart Adjustments: Universal search and top-bar shortcuts let you initiate key actions instantly, saving time and reducing friction.

- Recurring Invoices: Set up recurring invoices and send payment reminders in just a few clicks, perfect for retainers or subscription models.

Accounts Payable: Simplify Your Outflows

- Seamless Payables: Create one-time or recurring payables with ease, match with invoice attachments for better record-keeping.

- Flexible Payout Options: Send local or international disbursements instantly or on schedule, with built-in FX and currency controls.

- Optimised for Efficiency: Manage payables alongside payments, FX and have a view of payable lifecycle, all within one unified platform.

Network Highlights

New Payout Methods Now Live:

You can now send funds via Global Wires (GBP & EUR) and process Canada payouts (CAD) within our Money Movement module, giving you more flexibility across familiar currencies.

Finmo and Tribe Payments Join Forces to Unlock Card Issuing and Acquiring in Asia Pacific and Europe

We’re teaming up with Tribe Payments to bring card issuing and acquiring capabilities to APAC and Europe.This collaboration brings together Finmo’s global treasury infrastructure with Tribe’s card expertise, enabling businesses to launch and scale card programs faster, with a single partner across key markets.

Learn more about the partnership

From the Blog

Bringing Sexy Back to Treasury

Treasury isn’t just spreadsheets and reconciliations anymore — it’s the strategic engine powering growth, resilience, and real-time decision-making. In this post, we unpack why now is the moment to rethink treasury, and how modern CFOs are turning a back-office function into a competitive advantage.

On the Ground

Finmo at Money20/20 Europe

We made our debut at Money20/20 Europe, and what a week it was:

💥 We launched Mo.Ai, our finance copilot, to an audience buzzing with AI talk, and delivered a practical, built-in solution CFOs can actually use.

🎙️ Our CMO, Mansi Chopra, shared the stage with leaders from World Gold Council and Sterling Bank, unpacking how storytelling drives real business impact in fintech.

🤝 And we had the chance to connect with inspiring partners, prospects, and peers who are shaping the future of finance.

Vote for David – Fintech Frontiers 50

Our CEO David Hanna has been nominated for the Fintech Frontiers 50 Awards, recognizing the region’s most impactful fintech leaders. Finmo’s vision to unify payments, cash management, and FX risk management and unified integrations into a single intelligent platform is changing how finance teams operate across borders.

💙 If his work has inspired you, or if you believe in Finmo’s mission, we’d love your support.

That’s a wrap for this edition of Finmo Pulse. As we continue building the financial OS for modern businesses, we’re grateful to have you on this journey.

Stay tuned, stay smart, and as always, thank you for choosing Finmo.

Team Finmo

Smarter finance, delivered.

Try Finmo’s treasury dashboard today

Sign up to explore our dashboard for yourself. Or book a demo to talk things through with our team.