July newsletter: Finmo’s latest updates in treasury management

- Link copied

Welcome to the July edition of Finmo Pulse, your monthly roundup of product updates, insights, and innovations shaping the future of finance and treasury.

🇬🇧Finmo secures its UK EMI licence, expanding regulatory coverage to 6 global markets

💰 Now live: Unified cash visibility across banks, accounts, and currencies

✅ Launching Cashflow Analytics for a consolidated view of inflows, outflows, and FX impact

🧠 From the blog: Why generic AI tools fall short, and how MO AI is reshaping treasury workflows

📍 Save the date: Meet Finmo at industry events

🚀 Don’t miss our StartUp offer for early-stage businesses

Built for modern finance teams navigating complexity, scale, and speed, Finmo is here to help you move with confidence.

Let’s dive in.

Big Milestone

Finmo Secures UK EMI Licence

We’re proud to share a major milestone in Finmo’s journey: we’ve officially secured our Electronic Money Institution (EMI) licence in the United Kingdom.

With this, Finmo is now regulated in Singapore, Australia, New Zealand, Canada, the United States, and the United Kingdom. We're operating in the world’s key financial hubs where modern finance teams work.

This milestone reinforces our commitment to building a smarter, more secure financial infrastructure for globally ambitious businesses.

This milestone reinforces our commitment to building a smarter, more secure financial infrastructure for globally ambitious businesses. With this license, we’re strengthening our ability to deliver:

✅ Seamless cross-border money movement and cash management

✅ Localized support for UK-based enterprises

✅ Continued regulatory excellence, compliance, and security

This is more than a credential. It’s a leap forward in reimagining treasury operations

Product Highlights

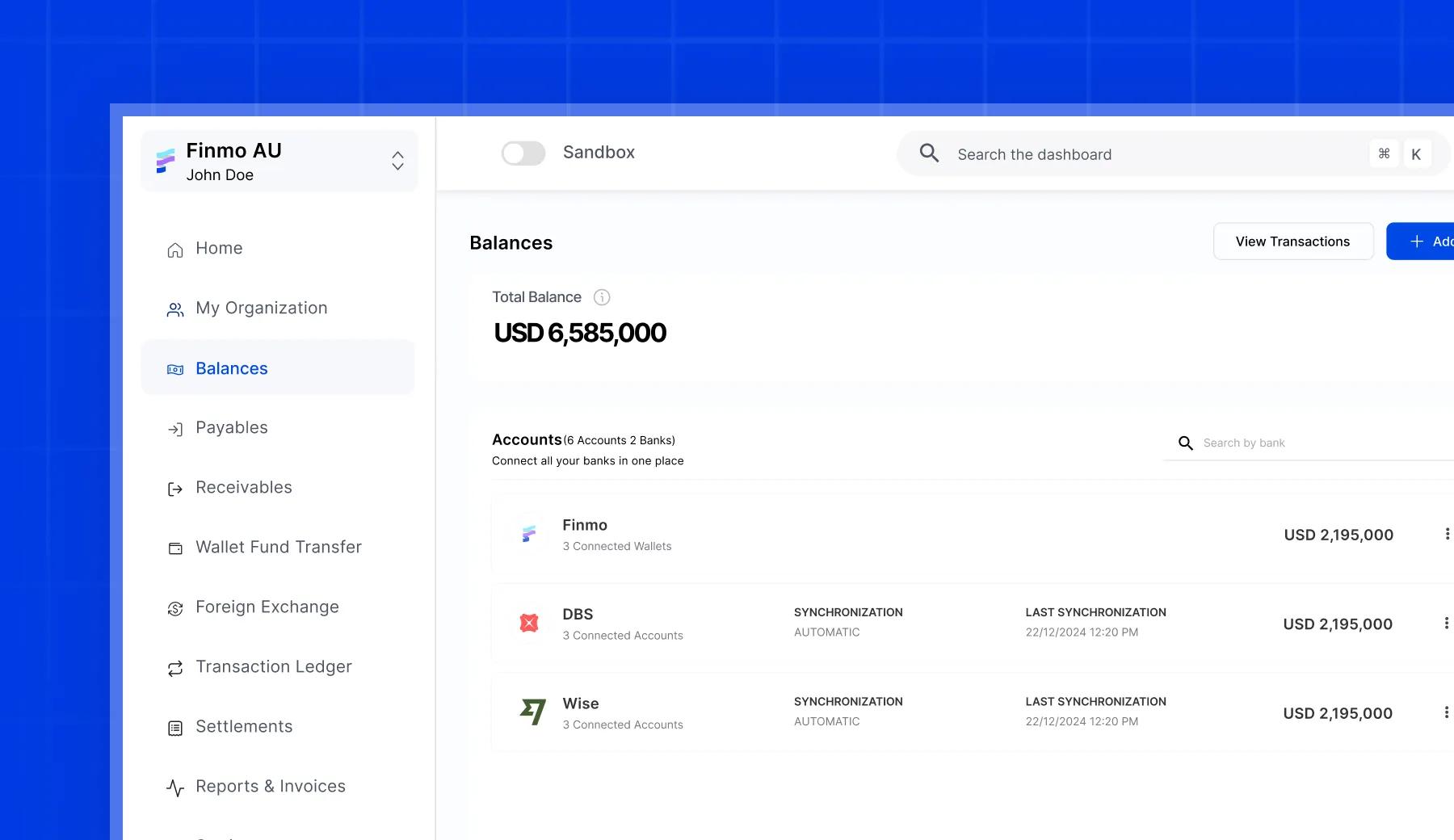

Real-Time Cash Visibility Now Live

For finance teams managing multiple accounts, currencies, and subsidiaries, answering a simple question like “how much cash do we have today?” often means logging into multiple bank portals, chasing spreadsheets, and waiting for updates.

With Finmo’s new Real-Time Cash Visibility, you get a single source of truth. See your company’s cash positions in real time, across all accounts, banks, and currencies, instantly.

Currently supported connections:

You can now link your DBS, Wise and Australian bank accounts. We’re continuously adding more integrations to support truly global coverage.

This milestone reinforces our commitment to building a smarter, more secure financial infrastructure for globally ambitious businesses. With this license, we’re strengthening our ability to deliver:

Key Highlights:

- Comprehensive Bank Data Aggregation: View transactions and balances from all your linked bank accounts directly on Finmo. No more toggling between portals.

- Multi-Bank Connectivity:Connect accounts via API or manually.

- Flexible Views:Switch between a consolidated view across all accounts or dive into specific account-level details with ease.

- Multi-Currency Insights:View balances in native currencies and in your chosen display currency.

- Granular Account Control:Choose which accounts to sync and track details.

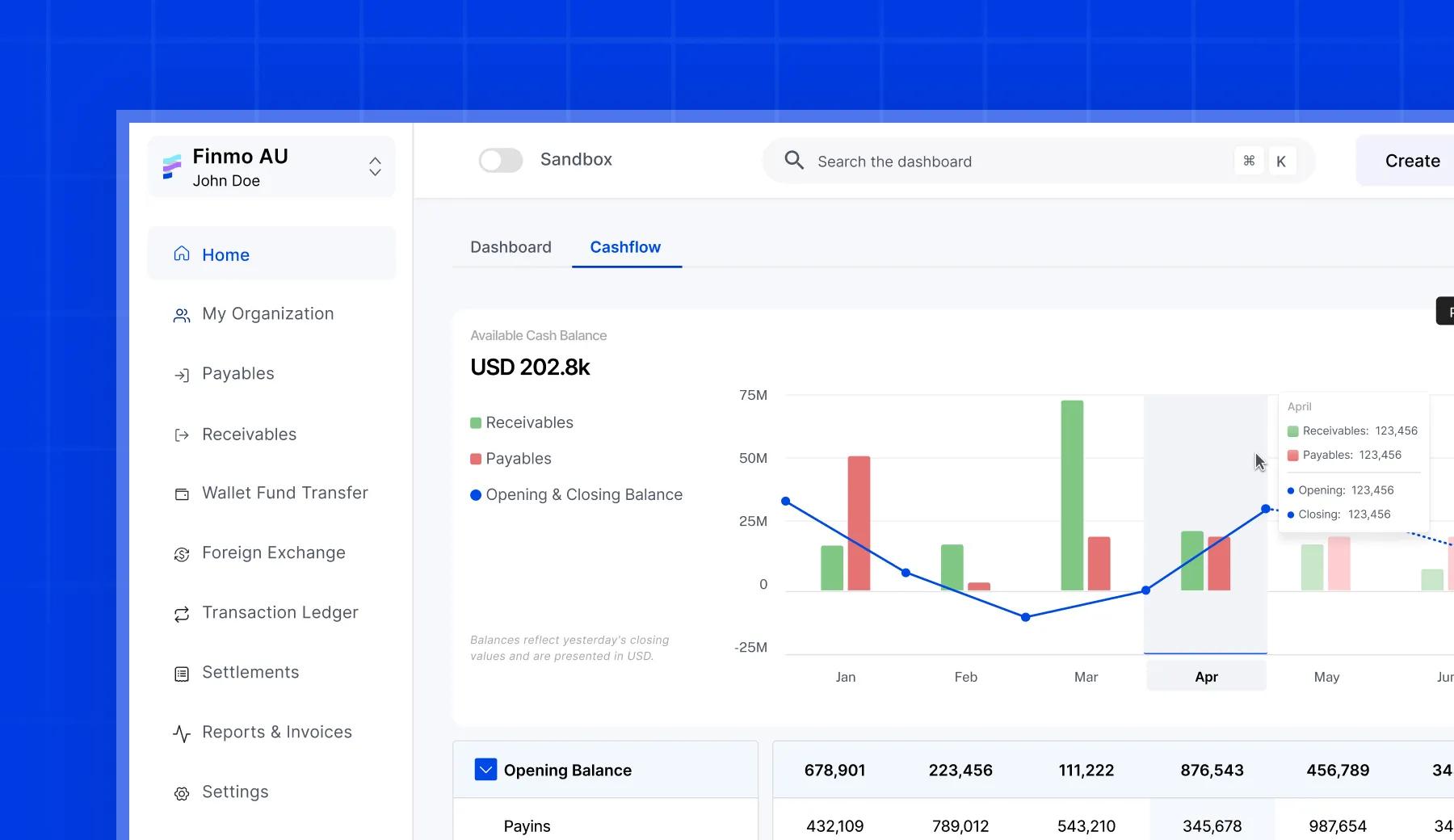

Introducing Cashflow Analytics

Managing global treasury operations requires more than balance snapshots. With Cashflow Analytics, we offer a clear, unified view of your company’s cash inflows, outflows, and available balances, simplifying how you track performance, identify trends, and reconcile across entities and currencies.

This is a key step in delivering on our vision of a unified Treasury Operating System, one that simplifies complexity, scales with you, and empowers finance teams with actionable insights.

Key Highlights:

- Wallet Balance Summary (USD)Build professional invoices using customizable templates and manage them all from a centralized dashboard.

- Transaction Summary – Inflows & OutflowsUnderstand your cash movements. Inflows include Payin and Accounts Receivable; outflows include Payout and Accounts Payable.

- Available Cash Balance (USD)Instantly see your current cash position in USD, updated as of today.

- Flexible Timeline ViewSwitch between monthly and quarterly views to analyze performance over time.

- FX Impact ReconciliationCapture and reconcile any variances caused by exchange rate fluctuations — transparently displayed under FX Impact.

Spotlight

Finmo’s vision has always been bigger than just payments. We're building the world’s first Treasury Operating System (TOS) — a single, integrated platform for global money movement, cash visibility, financial automation, and AI-driven insights.

Hear from our CEO, David Hanna, as he explains what TOS means for modern finance teams and how it’s reshaping the way businesses manage complexity at scale.

From the Blog

AI in Fintech: Why CFOs Are Shifting from Generic Tools to Purpose-Built Intelligence

AI is reshaping finance, but generic tools aren’t cutting it. In this article, we explore why more CFOs are moving away from surface-level AI assistants and toward intelligent, purpose-built systems designed for the complexity of modern finance.

A few insights from the article:

- Generic LLMs often miss the markLearn why finance-specific intelligence is essential for accuracy, compliance, and decision-making speed.

- How MO AI turns conversation into actionSee how Finmo’s AI assistant doesn’t just answer questions, it executes real financial workflows in real time.

- The rise of custom AI in fintechDiscover why industry leaders are building their own domain-specific AI models, not relying on off-the-shelf solutions.

On the Ground

Join us at these payments and finance industry events:

🗓️ July 2025

📍 FutureCFO Conference | Jakarta, Indonesia | 17 July

🗓️ August 2025

📍 Engage Asia | Kuala Lumpur, Malaysia | 18-19 August

📍 Treasury Tech: Secure Payment Conclave | Singapore | 26 August

🗓️ September 2025

📍 C -Engage Convention | Singapore | 11 September

Startup Offer

Startup Offer: Designed to Grow With You

If you’re a startup in your first 3 years, Finmo’s Startup Program is designed to help you move fast without the heavy upfront costs.

What’s included:

✅ Zero setup fees

✅ No platform fees for 12 months

✅ 25% discount on transaction fees for your first 6 months

✅ Priority access to new features

✅ Dedicated onboarding and support

✅ Full transparency via our Partner Portal — track every transaction, payout, and commission in real time

Whether you're building global payments into your product or streamlining internal finance ops, Finmo is AI-native, intuitive, and startup-friendly and ready to scale as you do.

Have thoughts or feedback? Let us know what you'd like to see in future editions.

Until next month,

Team Finmo

Try Finmo’s treasury dashboard today

Sign up to explore our dashboard for yourself. Or book a demo to talk things through with our team.